Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

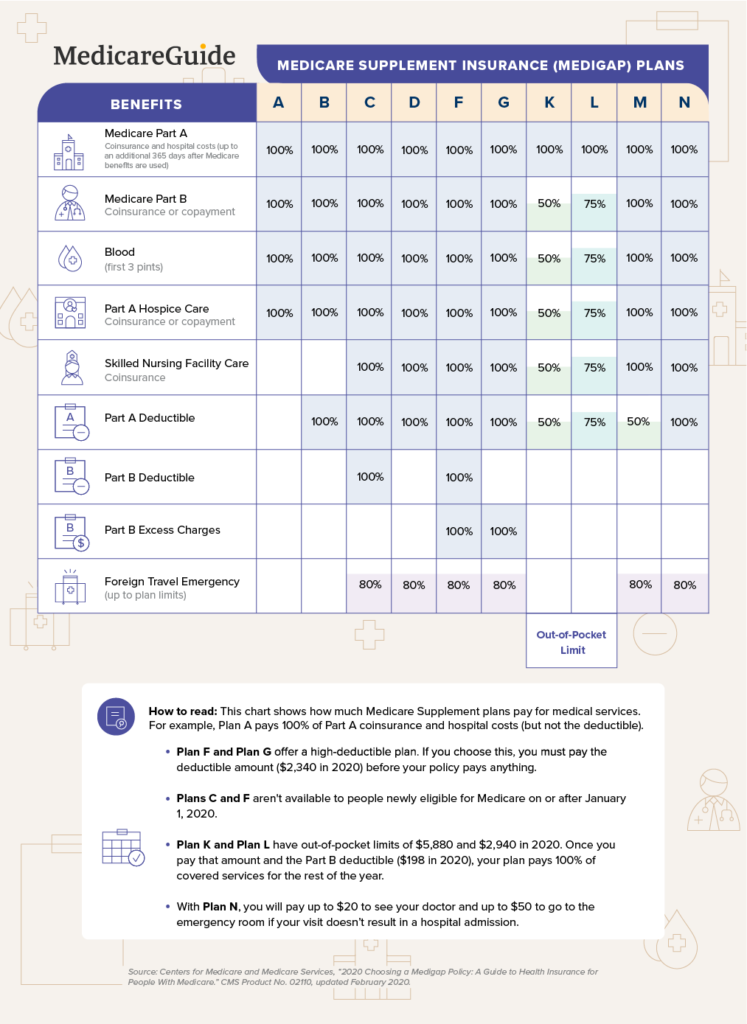

Medicare supplemental insurance is a crucial aspect of healthcare for many seniors in the United States. While original Medicare covers a lot of healthcare services, it does not cover everything. That’s where Medicare supplemental insurance, also known as Medigap, comes in. It provides additional coverage for things like copayments, deductibles, and coinsurance. However, there may come a time when you need to change your Medicare supplemental insurance plan. In this article, we will discuss when you can change your Medicare supplemental insurance and what you need to know before making any changes.

If you’re not happy with your current Medigap plan, you may be wondering when you can switch to a different plan. The good news is that you have several opportunities throughout the year to make changes to your Medicare supplemental insurance. However, there are certain restrictions and rules that you need to be aware of before making any changes. We will explore these rules and provide you with the information you need to make informed decisions about your Medicare supplemental insurance. So, let’s dive in and learn more about when you can change your Medigap plan.

When Can You Change Your Medicare Supplemental Insurance?

Medicare supplemental insurance, also known as Medigap, is an additional insurance policy designed to cover the gaps left by Original Medicare. While it is important to have a Medigap policy, it is equally important to know when you can change it. Here are the different situations in which you can change your Medicare supplemental insurance.

During the Open Enrollment Period

The open enrollment period is the best time to change your Medigap policy. This period lasts for six months and starts the month you turn 65 and enroll in Medicare Part B. During this period, you have the right to buy any Medigap policy sold in your state, regardless of your health status. You cannot be charged more for pre-existing conditions or denied coverage altogether.

If you enroll in a Medigap policy during the open enrollment period, you have a guaranteed issue right. This means that the insurance company cannot deny you coverage or charge you more for your policy. You can also choose to switch to a different Medigap policy during this time without any medical underwriting.

Outside the Open Enrollment Period

If you miss the open enrollment period, you can still change your Medigap policy, but there are certain restrictions. You will have to go through medical underwriting, and the insurance company can refuse to sell you a policy or charge you more for pre-existing conditions. However, there are some situations in which you can change your policy outside the open enrollment period without going through medical underwriting.

One such situation is if you have a Medicare Advantage plan and want to switch back to Original Medicare. You have a guaranteed issue right to buy a Medigap policy if you switch back to Original Medicare within the first year of enrolling in a Medicare Advantage plan. You can also change your Medigap policy if your current policy is ending, or if the insurance company goes bankrupt.

When Moving to a Different State

If you move to a different state, you may be able to switch to a different Medigap policy without medical underwriting. This is because some states have different Medigap plans than others. However, this may not always be possible, as some states may not allow you to switch plans without going through medical underwriting.

If you are moving to a different state, be sure to check the Medigap plans available in that state and see if you can switch to a different plan without any medical underwriting. If you cannot, you may have to keep your current Medigap policy or switch to a Medicare Advantage plan.

Benefits of Changing Your Medigap Policy

Changing your Medigap policy can have several benefits. For one, you may be able to get a policy that better suits your needs and budget. You can also switch to a policy that covers more services or has lower out-of-pocket costs.

Another benefit of changing your Medigap policy is that you may be able to save money. Different insurance companies charge different rates for the same policy, so by shopping around, you may be able to find a policy that is more affordable.

Medigap vs. Medicare Advantage

Medigap and Medicare Advantage are two different types of insurance policies. Medigap is a supplemental policy that works with Original Medicare to cover the gaps in coverage. Medicare Advantage is a private insurance policy that replaces Original Medicare and provides all of the same benefits, plus additional benefits like vision and dental.

While both types of policies have their pros and cons, it is important to understand the differences before you choose one. Medigap policies have more flexibility, as you can see any doctor that accepts Medicare. Medicare Advantage plans may have more benefits, but they also have more restrictions, such as network limitations and referrals.

Conclusion

Knowing when you can change your Medigap policy is important, as it can help you get the coverage you need at a price you can afford. By understanding the different situations in which you can change your policy, you can make an informed decision that is right for you.

Frequently Asked Questions

When can you change your Medicare supplemental insurance?

If you are enrolled in a Medicare supplemental insurance plan, also known as a Medigap plan, you may have the option to change your plan at certain times. The most common times to make changes to your Medigap plan are during the Medicare Open Enrollment Period, which runs from October 15th to December 7th each year, and during your Medigap Open Enrollment Period.

During your Medigap Open Enrollment Period, which is the six-month period that begins the month you turn 65 and are enrolled in Medicare Part B, you have guaranteed issue rights. This means that insurance companies cannot deny you coverage or charge you higher premiums based on your health status. You can switch to any Medigap plan offered in your state during this time.

After your Medigap Open Enrollment Period has ended, you may still be able to switch to a different plan, but you may be subject to medical underwriting. This means that insurance companies can review your health status and medical history to determine whether or not to accept your application and how much to charge you in premiums.

When Can I Change My Medicare Supplemental Insurance Plan

As a professional writer, I understand the importance of having a comprehensive understanding of topics related to healthcare, including Medicare supplemental insurance. When it comes to changing your Medicare supplemental insurance, there are various factors that you should consider to ensure that you are getting the best possible coverage for your needs.

One crucial factor to consider is the enrollment period for Medicare supplemental insurance. During the initial enrollment period, you have the flexibility to change your plan without any restrictions. However, if you miss this period, you may face limitations and penalties if you decide to switch to a different plan. Therefore, it is essential to keep track of your enrollment period and make any necessary changes during this time to avoid any potential issues.

In conclusion, changing your Medicare supplemental insurance can be a complex process that requires careful consideration of various factors. As a professional writer, I recommend that you consult with your healthcare provider and insurance agent to determine the best course of action for your specific needs. By staying informed and taking proactive steps to manage your coverage, you can ensure that you have the peace of mind and protection you need to maintain your health and well-being in the years to come.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts