Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As an individual or a business owner, you might have heard about the Index Universal Life Insurance policy, but you’re not sure if it’s the right investment for you. Index Universal Life Insurance is a type of permanent life insurance policy that falls under the umbrella of the Universal Life Insurance policy. It’s a complex insurance product that offers both life insurance coverage and an investment component.

The Index Universal Life Insurance policy has been gaining popularity in recent years, especially among individuals who are looking to maximize their returns while securing their families’ future. However, just like any investment product, it comes with its own set of pros and cons. In this article, we will explore the features of the Index Universal Life Insurance policy and help you determine if it’s a good investment for you.

Index Universal Life Insurance (IUL) is a type of permanent life insurance that offers tax-free death benefits and the potential for cash accumulation. It’s a good option for individuals who want to build savings while also protecting their loved ones. However, IUL can be complex and expensive, so it’s important to work with a trusted financial advisor to determine if it’s right for your unique financial goals and needs.

Contents

- Is Index Universal Life Insurance Good?

- Frequently Asked Questions

- Is Index Universal Life Insurance a good investment?

- What are the benefits of Index Universal Life Insurance?

- What are the risks of Index Universal Life Insurance?

- How do I decide if Index Universal Life Insurance is right for me?

- Is Index Universal Life Insurance better than other types of life insurance?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Is Index Universal Life Insurance Good?

Index universal life insurance (IUL) is a type of life insurance policy that combines the death benefit of traditional life insurance with the potential for tax-deferred investment gains. Unlike traditional universal life insurance, which offers a fixed interest rate, IUL policies allow policyholders to allocate a portion of their premiums to an indexed account, which is tied to the performance of a stock market index such as the S&P 500. But is IUL a good choice for you and your family? Let’s take a closer look.

How Does IUL Work?

An IUL policy has two components: the death benefit and the cash value. The death benefit is the amount that the policy will pay out to your beneficiaries when you die. The cash value is the portion of your premium that is invested in the indexed account, which can grow tax-deferred over time.

The indexed account is linked to the performance of a stock market index, such as the S&P 500. If the index performs well, the cash value of your policy will increase accordingly, up to a certain cap rate. If the index performs poorly, your cash value will not decrease, but it will not increase either.

Benefits of IUL

One of the biggest benefits of IUL is its flexibility. Policyholders can adjust their premiums and death benefit as their needs and circumstances change over time. Additionally, the tax-deferred growth of the indexed account can be a powerful tool for building wealth over the long term.

Another benefit of IUL is its potential for downside protection. Because the cash value is not directly tied to the performance of the stock market, policyholders can benefit from market gains without suffering losses during market downturns.

Drawbacks of IUL

Like any financial product, IUL has its drawbacks. One of the biggest concerns with IUL is the complexity of the product. Because of the investment component, IUL policies can be difficult to understand and compare to other insurance products.

Another potential drawback of IUL is the fees associated with the policy. Because of the investment component, IUL policies can have higher fees than traditional life insurance policies.

IUL vs. Other Life Insurance Products

When it comes to life insurance, there are many different products to choose from, including term life insurance, whole life insurance, and variable universal life insurance. So how does IUL compare?

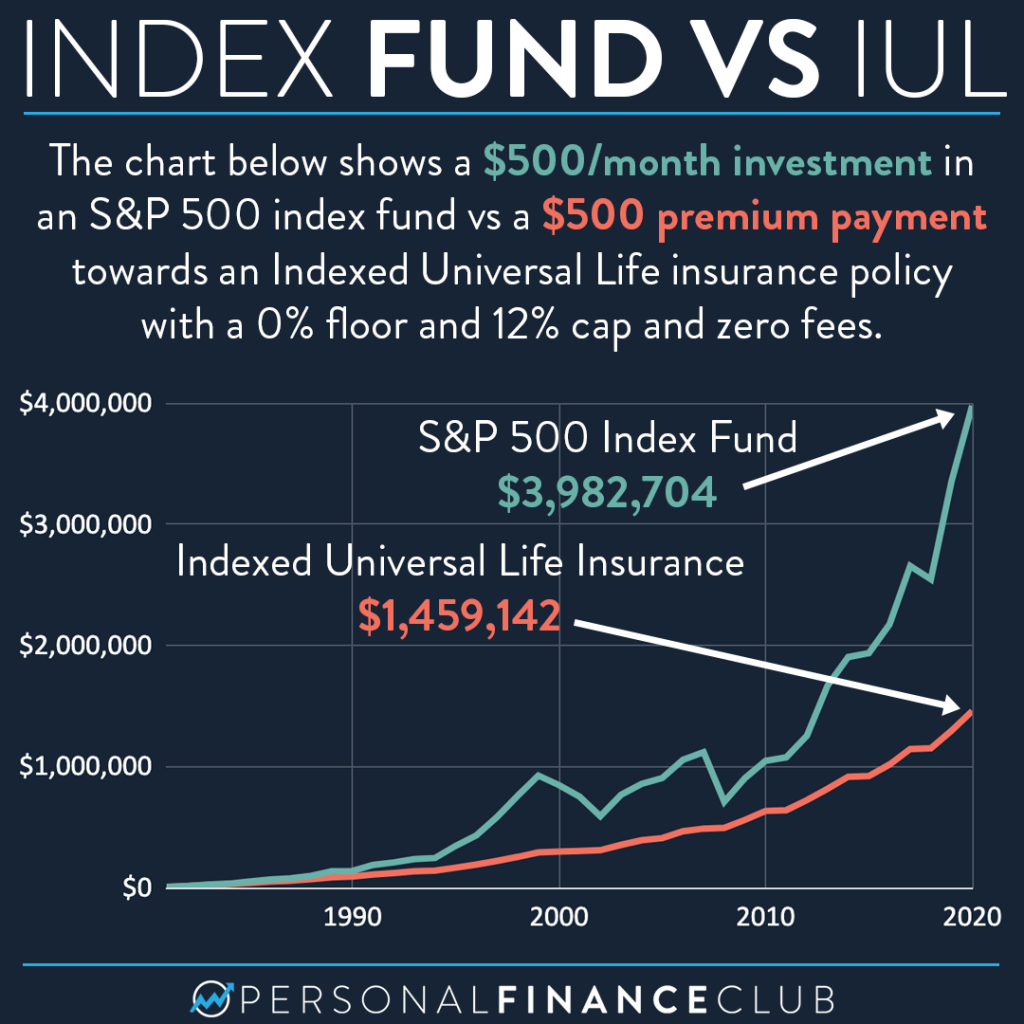

Compared to term life insurance, IUL offers the potential for tax-deferred investment gains, but its premiums are typically much higher. Compared to whole life insurance, IUL offers more flexibility and the potential for higher investment returns, but it also has higher fees and is more complex. Compared to variable universal life insurance, IUL offers more downside protection, but its investment returns are typically lower.

Is IUL Right for You?

Whether or not IUL is a good choice for you depends on a variety of factors, including your age, health, financial goals, and risk tolerance. If you are looking for a flexible life insurance policy with the potential for tax-deferred investment gains, and you are willing to pay higher premiums and deal with the complexity of the product, then IUL may be a good choice for you. However, if you are looking for a simple, low-cost life insurance policy, then IUL may not be the right fit.

The Bottom Line

Index universal life insurance can be a powerful tool for building wealth and protecting your family’s financial future. However, it is important to carefully consider your options and consult with a financial professional before making any decisions. By doing so, you can ensure that you are making the best choice for you and your family.

Frequently Asked Questions

Index Universal Life Insurance is a type of permanent life insurance that offers both a death benefit and a cash value component. It has gained popularity in recent years as a way to provide life insurance coverage while potentially building wealth over time. Here are some common questions and answers about Index Universal Life Insurance.

Is Index Universal Life Insurance a good investment?

Index Universal Life Insurance can be a good investment for some people, but it is not right for everyone. It offers the potential for tax-deferred growth and can be a good way to provide for your family and potentially build wealth over time. However, it is important to understand the risks involved, as the cash value component is tied to the performance of the stock market.

It is also important to consider your overall financial goals and whether Index Universal Life Insurance fits into your long-term strategy. Consulting with a financial professional can help you determine if this type of policy is a good fit for you.

What are the benefits of Index Universal Life Insurance?

Index Universal Life Insurance offers several benefits, including a death benefit that can provide financial security for your loved ones. The policy also has a cash value component that can potentially grow over time, offering a source of savings and investment. Additionally, the policy can offer tax advantages, as the cash value can grow tax-deferred and the death benefit is typically received tax-free.

Another benefit of Index Universal Life Insurance is the flexibility it offers. You can adjust the death benefit and premium payments to meet your changing needs and financial situation. Additionally, some policies offer riders that can provide additional benefits, such as long-term care coverage or a waiver of premium if you become disabled.

What are the risks of Index Universal Life Insurance?

While Index Universal Life Insurance offers potential benefits, it also comes with risks. The cash value component of the policy is tied to the performance of the stock market, so if the market performs poorly, the cash value may not grow as expected. Additionally, there are fees and expenses associated with the policy that can impact the growth of the cash value.

It is also important to understand that the policy may require a minimum interest rate to be credited to the cash value, and if the interest rate falls below this minimum, you may need to pay additional premiums to keep the policy in force. Finally, it is important to consider whether the policy fits into your overall financial strategy and whether you can afford the premiums over the long term.

How do I decide if Index Universal Life Insurance is right for me?

Choosing whether or not to purchase Index Universal Life Insurance is a personal decision that should be based on your individual financial situation and goals. It is important to consider your overall financial strategy and whether the policy fits into that strategy. Additionally, you should consider your risk tolerance and whether you are comfortable with the potential risks associated with the policy.

Consulting with a financial professional can help you determine if Index Universal Life Insurance is a good fit for you. They can help you understand the potential benefits and risks of the policy and can provide advice on how the policy fits into your overall financial plan.

Is Index Universal Life Insurance better than other types of life insurance?

Index Universal Life Insurance is not necessarily better or worse than other types of life insurance. It is a unique type of policy that offers both a death benefit and a cash value component that can potentially grow over time. Whether or not it is the right choice for you depends on your individual financial situation and goals.

Other types of life insurance, such as term life insurance or whole life insurance, may be better suited to your needs. It is important to consider the benefits and drawbacks of each type of policy and to consult with a financial professional before making a decision.

After exploring the ins and outs of index universal life insurance, it is clear that this type of policy can be a valuable option for certain individuals. With its potential to generate higher returns than traditional whole life insurance policies and its flexibility in adjusting premium payments and death benefits, index universal life insurance can provide a unique solution for those looking to protect their loved ones and build wealth over time.

However, it is important to note that index universal life insurance may not be the best fit for everyone. As with any financial decision, it is crucial to carefully evaluate your individual circumstances and goals before committing to a policy. Consulting with a trusted financial advisor can help you determine whether index universal life insurance is a good choice for you and your family. Ultimately, by taking the time to educate yourself and make an informed decision, you can achieve greater peace of mind and security for your future.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts