Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

If you’re reading this, chances are you’re looking for a way to cancel your Lincoln Heritage Life Insurance policy. Whether you’re dissatisfied with the coverage, found a better option, or simply don’t need it anymore, canceling your policy can seem like a daunting task. However, with the right knowledge and preparation, canceling your Lincoln Heritage Life Insurance policy can be a straightforward process.

First and foremost, it’s important to understand the terms and conditions of your policy and the cancellation process. Lincoln Heritage Life Insurance policies may have different cancellation policies depending on the state in which you live and the type of policy you have. It’s important to review your policy documents and speak with a customer service representative to fully understand your options and any potential consequences of cancelling your policy. In this guide, we’ll walk you through the steps to cancel your Lincoln Heritage Life Insurance policy and provide helpful tips to make the process as smooth as possible.

- Call the customer service number at 1-800-438-7180.

- Provide your policy details and reason for cancellation.

- Follow the instructions given by the representative.

- Confirm the cancellation in writing through email or mail.

How to Cancel Lincoln Heritage Life Insurance?

If you have decided to cancel your Lincoln Heritage Life Insurance policy, you may be wondering about the process. Cancelling a life insurance policy can be a difficult decision, but it’s important to know how to navigate the process. In this article, we will guide you through the steps to cancel your Lincoln Heritage Life Insurance policy.

Reasons to Cancel Lincoln Heritage Life Insurance

Before we dive into the process of cancelling your Lincoln Heritage Life Insurance policy, let’s take a look at some reasons why you may want to cancel your policy.

1. You no longer need life insurance coverage: If you have reached a point in your life where you no longer need life insurance coverage, you may want to consider cancelling your policy.

2. High premiums: If you find that your premiums are too high and you are struggling to keep up with payments, you may want to cancel your policy.

3. Better options: If you have found a better life insurance policy that meets your needs and offers better terms, you may want to cancel your Lincoln Heritage Life Insurance policy.

4. Financial difficulties: If you are experiencing financial difficulties and can no longer afford your life insurance policy, it may be time to cancel it.

If any of these reasons resonate with you, then it may be time to cancel your Lincoln Heritage Life Insurance policy.

Steps to Cancel Lincoln Heritage Life Insurance

1. Review your policy: Before cancelling your policy, review the terms and conditions of your Lincoln Heritage Life Insurance policy to understand any implications or fees associated with cancellation.

2. Contact your agent: Contact your agent and inform them of your decision to cancel your policy. They will guide you through the process and provide you with the necessary paperwork to complete the cancellation.

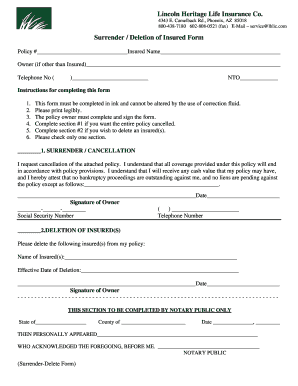

3. Complete the paperwork: Fill out the necessary paperwork provided by your agent to cancel your policy. This may include a cancellation form and a surrender form.

4. Return the paperwork: Once you have completed the paperwork, return it to your agent. Make sure to keep a copy of the paperwork for your records.

5. Confirm cancellation: Confirm with your agent that your policy has been cancelled and that you will no longer receive any bills or statements.

Benefits of Cancelling Lincoln Heritage Life Insurance

There are several benefits to cancelling your Lincoln Heritage Life Insurance policy. These include:

1. Cost savings: Cancelling your policy can save you money on monthly premiums that you can use towards other expenses.

2. Flexibility: Without a life insurance policy, you have more financial flexibility to allocate your funds towards other financial goals.

3. Peace of mind: If you no longer need life insurance coverage, cancelling your policy can provide peace of mind and alleviate any unnecessary stress.

Lincoln Heritage Life Insurance Vs Other Life Insurance Policies

When comparing Lincoln Heritage Life Insurance to other life insurance policies, it’s important to consider the following:

1. Premiums: Lincoln Heritage Life Insurance premiums may be higher than other policies.

2. Coverage: Other policies may offer more comprehensive coverage options.

3. Flexibility: Other policies may offer more flexibility in terms of payment options and policy terms.

Ultimately, the decision to cancel your Lincoln Heritage Life Insurance policy depends on your personal financial situation and needs. Review your policy and consider your options carefully before making a decision.

Contents

- Frequently Asked Questions

- What is Lincoln Heritage Life Insurance?

- How do I cancel my Lincoln Heritage Life Insurance policy?

- Is there a fee to cancel my Lincoln Heritage Life Insurance policy?

- Will I receive a refund if I cancel my Lincoln Heritage Life Insurance policy?

- Can I cancel my Lincoln Heritage Life Insurance policy at any time?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

What is Lincoln Heritage Life Insurance?

Lincoln Heritage Life Insurance is a provider of final expense life insurance. The company offers policies that cover funeral and burial costs for policyholders and their loved ones. The company has been in business since 1963 and has served over one million policyholders.

If you have a policy with Lincoln Heritage and need to cancel it for any reason, you can do so by following a few simple steps.

How do I cancel my Lincoln Heritage Life Insurance policy?

If you want to cancel your Lincoln Heritage Life Insurance policy, you will need to contact the company’s customer service department. You can call the customer service number listed on the company’s website or on your policy documents.

When you call, you will need to provide your policy number and other information to verify your identity. The customer service representative will then walk you through the cancellation process and answer any questions you may have.

Is there a fee to cancel my Lincoln Heritage Life Insurance policy?

There is no fee to cancel your Lincoln Heritage Life Insurance policy. However, depending on the terms of your policy, you may be subject to a surrender charge or other penalties if you cancel before the end of the policy term.

Be sure to read your policy documents carefully before you cancel to understand any potential charges or fees that may apply.

Will I receive a refund if I cancel my Lincoln Heritage Life Insurance policy?

If you cancel your Lincoln Heritage Life Insurance policy, you may be eligible for a refund of any premiums you have paid. However, the amount of the refund will depend on the terms of your policy.

Be sure to ask the customer service representative about any potential refunds when you call to cancel your policy.

Can I cancel my Lincoln Heritage Life Insurance policy at any time?

Most Lincoln Heritage Life Insurance policies can be canceled at any time. However, depending on the terms of your policy, you may be subject to a surrender charge or other penalties if you cancel before the end of the policy term.

Be sure to read your policy documents carefully before you cancel to understand any potential charges or fees that may apply.

Canceling a life insurance policy can be a difficult decision, but sometimes it is necessary. If you have decided to cancel your Lincoln Heritage Life Insurance policy, it is important to follow the proper steps to ensure a smooth and hassle-free process. By taking the time to do your research and preparing ahead of time, you can cancel your policy with confidence and peace of mind.

In conclusion, canceling a life insurance policy is not always an easy task. However, by following the steps outlined above, you can ensure that the process goes smoothly and that you make the best decision for your financial future. Remember to do your research, prepare ahead of time, and communicate clearly with your insurance company. With these tips in mind, you can cancel your Lincoln Heritage Life Insurance policy with confidence and ease.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts