Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Life insurance is a crucial investment that everyone should consider, especially if they have loved ones who depend on their income. Term life insurance is one of the most popular types of life insurance policies, as it offers affordable premiums and coverage for a specified period. One question that many people ask is, “How much does 2 million in term life insurance cost?”

The answer to this question depends on several factors, such as the age, health, and lifestyle of the policyholder. In this article, we will explore the various factors that affect the cost of a 2 million term life insurance policy and provide you with an estimate of the premium you can expect to pay. We will also discuss the benefits of investing in a term life insurance policy and why it is essential to secure the financial future of your loved ones. So, let’s dive in and explore the cost of 2 million in term life insurance.

How Much Does 2 Million in Term Life Insurance Cost?

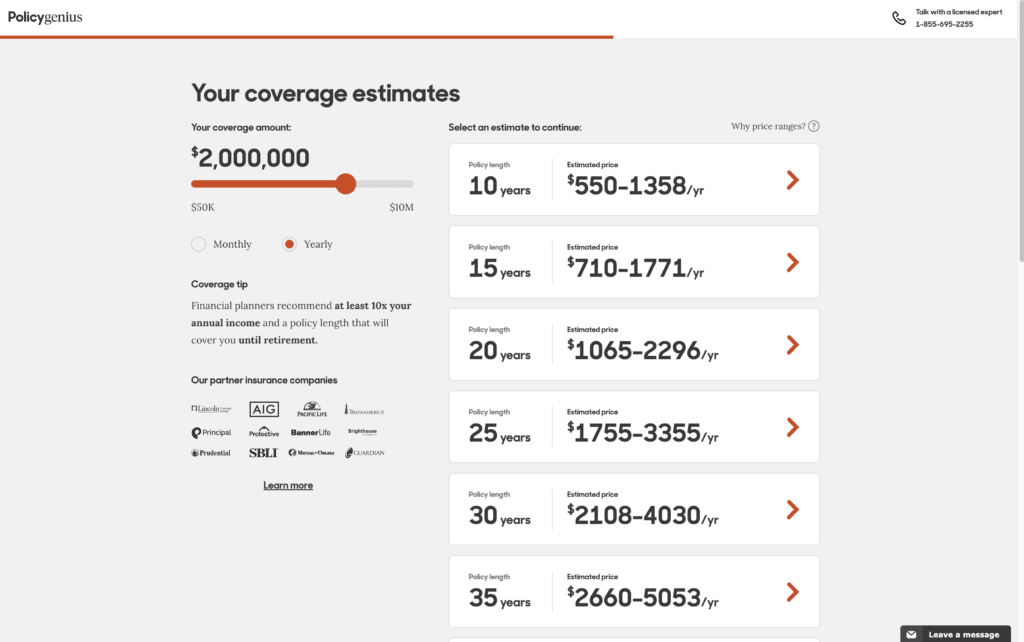

The cost of a 2 million dollar term life insurance policy varies based on several factors such as age, gender, health, and term length. On average, a healthy 35-year-old male can expect to pay around $40-$50 a month for a 20-year term policy. However, rates may vary depending on the insurance company and individual circumstances. It’s best to compare quotes from multiple insurers to find the best deal.

How Much Does 2 Million in Term Life Insurance Cost?

Understanding Term Life Insurance

Term life insurance is a type of life insurance policy that provides coverage for a specified period of time. This type of insurance policy is a popular choice for individuals who want to ensure that their loved ones are financially secure in the event of their death. The cost of term life insurance can vary depending on a number of factors, including the amount of coverage you need, your age, and your overall health.

When you purchase a term life insurance policy, you will pay a monthly or annual premium in exchange for coverage for a specified period of time. If you pass away during the term of the policy, your beneficiaries will receive the death benefit.

Factors That Affect the Cost of Term Life Insurance

There are several factors that can impact the cost of your term life insurance policy. These include:

1. Age: Generally, the younger you are when you purchase a term life insurance policy, the lower your premium will be.

2. Health: Your overall health is a major factor in determining the cost of your term life insurance policy. Insurance companies will typically require a medical exam before issuing a policy.

3. Lifestyle: Certain lifestyle factors, such as smoking or participating in high-risk activities, can increase the cost of your term life insurance policy.

4. Coverage amount: The amount of coverage you need will impact the cost of your term life insurance policy. The more coverage you need, the higher your premium will be.

How Much Does 2 Million in Term Life Insurance Cost?

The cost of a 2 million dollar term life insurance policy can vary depending on your age, health, and other factors. However, as a general rule, a healthy individual in their 30s or 40s can expect to pay around $150-$200 per month for a 20-year term life insurance policy with a death benefit of 2 million dollars.

It’s important to note that the cost of term life insurance can vary widely depending on your individual circumstances. For example, if you have a pre-existing medical condition or engage in high-risk activities, your premium may be significantly higher.

Benefits of 2 Million Dollar Term Life Insurance

A 2 million dollar term life insurance policy can provide a number of benefits for your loved ones in the event of your death. These benefits include:

1. Financial security: A 2 million dollar death benefit can help ensure that your loved ones are financially secure after you pass away.

2. Debt repayment: If you have outstanding debts, such as a mortgage or student loans, a 2 million dollar death benefit can help ensure that those debts are paid off.

3. Education expenses: If you have children, a 2 million dollar death benefit can help cover their education expenses.

4. Estate planning: A 2 million dollar term life insurance policy can be an important part of your overall estate planning strategy.

Term Life Insurance vs. Permanent Life Insurance

When considering life insurance options, it’s important to understand the difference between term life insurance and permanent life insurance.

Term life insurance provides coverage for a specified period of time, typically 10, 20, or 30 years. Permanent life insurance, on the other hand, provides coverage for your entire life and can also include an investment component.

While permanent life insurance can be a good option for some individuals, it is typically much more expensive than term life insurance. For most people, term life insurance is a more affordable and practical option.

Final Thoughts

If you’re considering purchasing a 2 million dollar term life insurance policy, it’s important to do your research and shop around to find the best policy for your individual needs. Be sure to compare quotes from multiple insurance providers and carefully consider the factors that can impact your premium.

Ultimately, a 2 million dollar term life insurance policy can provide valuable financial protection for your loved ones in the event of your death. By taking the time to find the right policy, you can have peace of mind knowing that your family will be taken care of.

Contents

- Frequently Asked Questions

- What factors affect the cost of a $2 million term life insurance policy?

- How much can I expect to pay for a $2 million term life insurance policy?

- What are some ways to lower the cost of a $2 million term life insurance policy?

- Is a $2 million term life insurance policy right for me?

- How do I apply for a $2 million term life insurance policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Term life insurance is a popular type of life insurance policy that provides coverage for a fixed period of time, typically between 10 and 30 years. If you’re considering purchasing a term life insurance policy with $2 million in coverage, you may be wondering how much it will cost. Here are some frequently asked questions and answers to help you understand the cost of a $2 million term life insurance policy.

What factors affect the cost of a $2 million term life insurance policy?

The cost of a $2 million term life insurance policy is influenced by several factors, including your age, gender, health, occupation, hobbies, and lifestyle. Younger, healthier individuals with low-risk lifestyles typically pay less for term life insurance than older individuals with health issues or high-risk hobbies. Additionally, longer-term policies tend to be more expensive than shorter-term policies.

When shopping for a $2 million term life insurance policy, be sure to compare quotes from multiple providers to find the most affordable coverage that meets your needs.

How much can I expect to pay for a $2 million term life insurance policy?

The cost of a $2 million term life insurance policy varies depending on the factors mentioned above. However, as a general rule, a healthy 30-year-old non-smoking male can expect to pay between $50 and $100 per month for a 20-year term policy with $2 million in coverage. A healthy 30-year-old non-smoking female can expect to pay between $40 and $90 per month for the same coverage.

However, if you have health issues or engage in high-risk activities, you can expect to pay more for your policy. Additionally, longer-term policies will cost more than shorter-term policies.

What are some ways to lower the cost of a $2 million term life insurance policy?

If you’re looking to lower the cost of a $2 million term life insurance policy, there are several strategies you can try. One option is to choose a shorter-term policy, such as a 10-year term instead of a 20-year term. Another option is to improve your health by quitting smoking, losing weight, or improving your diet and exercise habits. Additionally, you can compare quotes from multiple insurance providers to find the most affordable coverage.

Keep in mind that while it may be tempting to choose the cheapest policy available, it’s important to make sure that you’re getting the coverage you need to protect your loved ones in the event of your untimely death.

Is a $2 million term life insurance policy right for me?

Whether or not a $2 million term life insurance policy is right for you depends on your individual circumstances and financial goals. If you have dependents who rely on your income, a $2 million policy can provide valuable financial protection in the event of your death. Additionally, if you have significant debts or expenses that would be difficult for your loved ones to pay without your income, a $2 million policy can help cover those costs.

However, if you don’t have dependents or significant financial obligations, a $2 million policy may be more than you need. It’s important to carefully consider your financial situation and goals when choosing a life insurance policy.

How do I apply for a $2 million term life insurance policy?

To apply for a $2 million term life insurance policy, you’ll need to start by researching insurance providers and comparing quotes. Once you’ve chosen a provider, you’ll need to fill out an application and provide information about your health, lifestyle, and financial situation. Depending on the provider, you may also need to undergo a medical exam or provide additional documentation.

Once you’ve been approved for coverage, you’ll need to pay your premiums on time to maintain your policy. If you pass away during the term of your policy, your beneficiaries will receive a tax-free payout of $2 million.

In today’s uncertain times, having a safety net in place for your loved ones is essential. Term life insurance is a popular option that provides financial protection for a specific period. However, the question of how much it costs can be complex and varies depending on several factors such as age, health, and coverage amount.

In conclusion, while the cost of 2 million in term life insurance may seem significant, it is a small price to pay for the peace of mind it can bring. By working with an experienced insurance agent and carefully considering your needs and budget, you can find a policy that fits your unique situation. Investing in term life insurance is an investment in your family’s future and a wise decision for anyone who wants to ensure their loved ones are taken care of in the event of the unexpected.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts