Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As an employee, you may have heard about group term life insurance as part of your company’s benefits package. This type of life insurance policy provides coverage for a group of people, typically employees of the same organization. While it’s an excellent benefit to have, you may be wondering if group term life insurance is taxable.

The answer is not a straightforward yes or no. The taxation of group term life insurance depends on several factors, including the amount of coverage you receive, who pays for the premiums, and the purpose of the policy. In this article, we will explore the intricacies of group term life insurance taxation and provide you with a comprehensive guide to help you understand how it works.

Group term life insurance is not taxable as long as the coverage amount is below $50,000. However, if the coverage amount exceeds $50,000, the excess amount is considered taxable income and is subject to federal income tax. Additionally, any employer-paid premiums on coverage exceeding $50,000 are also considered taxable income. It’s important to note that state tax laws may vary.

Contents

- Is Group Term Life Insurance Taxable?

- Frequently Asked Questions

- 1. Is group term life insurance taxable?

- 2. What is imputed income?

- 3. Are there any exceptions to the imputed income rule?

- 4. Are premiums for voluntary group term life insurance taxable?

- 5. How is group term life insurance taxed after retirement?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Is Group Term Life Insurance Taxable?

Group term life insurance is a type of coverage that is provided to a group of individuals by an employer or organization. This type of insurance policy is designed to provide coverage for a large number of people at a more affordable rate than individual life insurance policies. However, when it comes to taxes, there are some important considerations to keep in mind. In this article, we will explore whether group term life insurance is taxable or not.

Understanding Group Term Life Insurance

Group term life insurance is a type of life insurance that is provided to a group of people, usually employees of a company or members of an organization. The policy is owned by the employer or organization, and the premiums are paid by the employer or sometimes shared by the employees. The coverage is typically provided in a lump sum amount, which is paid out to the beneficiary in the event of the insured’s death.

How Group Term Life Insurance Works?

Group term life insurance is designed to provide affordable coverage to a large group of people. Insurance companies offer group term life insurance policies to employers or organizations, who then offer the coverage to their employees or members. The employer or organization typically pays the premiums for the policy, although sometimes employees may be required to contribute to the cost of the coverage.

Types of Group Term Life Insurance Policy

There are two types of group term life insurance policies: noncontributory and contributory. In a noncontributory policy, the employer pays the entire premium for the coverage. In a contributory policy, the employer and the employees share the cost of the premiums.

Is Group Term Life Insurance Taxable?

Group term life insurance is generally not taxable to the employee, as long as the coverage does not exceed a certain amount. The first $50,000 of group term life insurance coverage is not taxable to the employee, regardless of whether the policy is noncontributory or contributory.

When Group Term Life Insurance is Taxable?

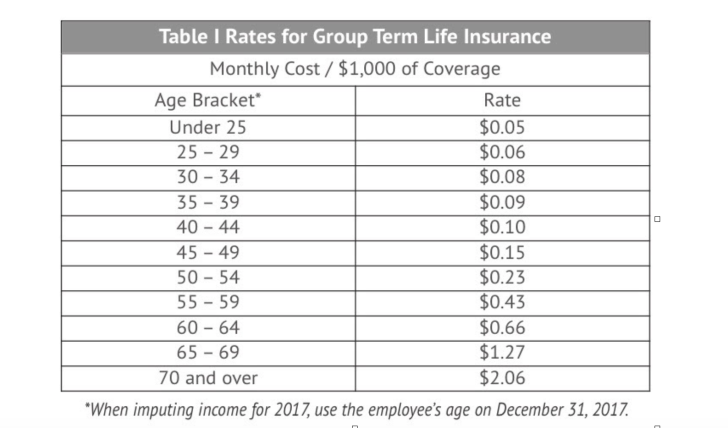

If the coverage exceeds $50,000, the excess is considered taxable income to the employee. The amount of the excess is calculated using a table provided by the IRS, which takes into account the employee’s age and the amount of coverage over $50,000.

Other Tax Considerations for Group Term Life Insurance

In addition to the taxable income considerations, there are other tax implications to consider when it comes to group term life insurance. For example, if the employer pays the premiums for the policy, the premiums are generally tax-deductible as a business expense. On the other hand, if the employee pays a portion of the premiums, the portion paid by the employee is generally not tax-deductible.

Benefits of Group Term Life Insurance

Group term life insurance can provide a number of benefits to both employers and employees. For employers, offering group term life insurance as part of a benefits package can help attract and retain employees, and may also help to reduce turnover. For employees, group term life insurance can provide affordable coverage, often without the need for medical exams or underwriting.

Group Term Life Insurance Vs Individual Life Insurance

Compared to individual life insurance, group term life insurance can be much more affordable, especially for older employees or those with pre-existing medical conditions. However, group term life insurance policies typically offer lower coverage amounts than individual policies, and the coverage is not portable.

How to Determine the Need for Group Term Life Insurance?

The decision to offer group term life insurance as an employer or to enroll in a policy as an employee should be based on a number of factors, including the size of the organization, the age and health of the employees, and the overall cost of the coverage. It is important to carefully consider all of these factors before making a decision.

Conclusion

Group term life insurance can be a valuable benefit for both employers and employees. While the coverage is generally not taxable to the employee, there are some important considerations to keep in mind, particularly when it comes to coverage amounts over $50,000. By understanding these tax implications and other factors, employers and employees can make informed decisions about whether group term life insurance is right for them.

Frequently Asked Questions

Group term life insurance is a common form of life insurance that provides coverage to a group of individuals. Many people wonder if this type of insurance is taxable. Here are some common questions and answers about group term life insurance and taxes.

1. Is group term life insurance taxable?

Group term life insurance is generally not taxable if the premiums are paid by the employer and the coverage amount is less than $50,000. However, if the coverage amount exceeds $50,000, the portion of the premium paid by the employer that covers the excess amount is taxable income to the employee.

Additionally, if an employee receives group term life insurance coverage as part of a compensation package, the value of the coverage may also be taxable as income to the employee.

2. What is imputed income?

Imputed income is the value of the group term life insurance coverage that exceeds $50,000. This excess amount is considered taxable income to the employee and is subject to federal income tax withholding. The employer must calculate and report the imputed income on the employee’s W-2 form.

It is important to note that imputed income only applies to the portion of the premium paid by the employer that covers the excess coverage amount. The portion of the premium paid by the employee is not taxable.

3. Are there any exceptions to the imputed income rule?

Yes, there are some exceptions to the imputed income rule. If the excess coverage amount is due to a qualified event, such as the employee’s death or retirement, the imputed income may be waived. Additionally, if the group term life insurance is provided to a highly compensated employee, the imputed income may be reduced or waived.

Employers should consult with their tax advisor for specific details on exceptions to the imputed income rule.

Yes, premiums for voluntary group term life insurance are generally taxable. This is because the premiums are paid by the employee and are not considered a fringe benefit provided by the employer. However, the death benefit paid out to the employee’s beneficiary is generally tax-free.

It is important for employees to consult with their tax advisor to determine the tax implications of voluntary group term life insurance.

5. How is group term life insurance taxed after retirement?

Group term life insurance that is provided to retirees is generally taxable as income. This is because the coverage is no longer considered a fringe benefit provided by the employer. The retiree must include the value of the coverage in their taxable income for the year.

It is important for retirees to consult with their tax advisor for specific details on the tax implications of group term life insurance after retirement.

In conclusion, it is important to understand the tax implications of group term life insurance. While the premiums paid by employers are typically tax deductible, the death benefit may be subject to taxation if it exceeds a certain threshold. It is important for employees to consult with a tax professional to determine the best course of action for their individual circumstances.

Overall, group term life insurance can provide valuable financial protection for both employers and employees. However, it is essential to carefully consider the tax implications and to seek expert advice to ensure that the policy is structured in the most advantageous way. With the right approach, group term life insurance can be a valuable and cost-effective way to provide peace of mind for both employers and their staff.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts