Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Life insurance is an essential financial protection that provides peace of mind to individuals and families. It is a contract between the insurer and the policyholder, where the insurer agrees to pay a lump sum amount to the beneficiaries in the event of the policyholder’s death. However, many people are unaware of the factors that affect their life insurance payout, such as pre-existing medical conditions like cirrhosis.

Cirrhosis is a severe liver disease that can result in liver failure and increase the risk of death. The condition is caused by chronic alcohol abuse, hepatitis, or other liver diseases. If you have cirrhosis, you may be wondering whether your life insurance policy will payout to your beneficiaries in the event of your death. In this article, we will discuss the implications of cirrhosis on your life insurance payout and what you can do to ensure your loved ones are protected.

Yes, life insurance policies generally cover death due to cirrhosis. However, the amount of payout may depend on the severity of the condition and the terms of the policy. Some policies may have exclusions for pre-existing conditions or require a waiting period before providing coverage. It is important to review your policy and speak with your insurance provider for more information.

Contents

- Will Life Insurance Payout for Cirrhosis?

- Frequently Asked Questions

- What is Cirrhosis?

- Will Life Insurance Payout for Cirrhosis?

- Can I Get Life Insurance if I Have Cirrhosis?

- What Type of Life Insurance is Best for Someone with Cirrhosis?

- What Should I Consider When Buying Life Insurance with Cirrhosis?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Will Life Insurance Payout for Cirrhosis?

Cirrhosis is a serious liver disease that can lead to life-threatening complications. If you have been diagnosed with cirrhosis, you may be wondering if your life insurance policy will pay out in the event of your death. This article will explore the factors that determine whether your life insurance policy will pay out if you die from cirrhosis.

How Life Insurance Works

Before we dive into the specifics of cirrhosis and life insurance, let’s briefly review how life insurance works. When you purchase a life insurance policy, you pay premiums to the insurance company. In exchange, the insurance company agrees to pay a death benefit to your designated beneficiaries in the event of your death.

The amount of the death benefit depends on the type of policy you have and the amount of coverage you purchased. There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specified period of time, while permanent life insurance provides coverage for your entire life.

Factors That Affect Life Insurance Payout for Cirrhosis

When you apply for life insurance, you will be asked to complete a medical exam and answer questions about your health. If you have been diagnosed with cirrhosis, the insurance company will take that into consideration when determining your eligibility for coverage and the cost of your premiums.

If you already have a life insurance policy and are later diagnosed with cirrhosis, your policy will still pay out if you die from the disease. However, there are a few factors that could affect the payout amount.

One factor is the type of policy you have. If you have a term life insurance policy that is set to expire soon, the death benefit may be lower than if you had a permanent life insurance policy. Additionally, some policies have exclusions for certain types of illnesses, including cirrhosis. If your policy has such an exclusion, your beneficiaries may not receive a payout if you die from cirrhosis.

Benefits of Life Insurance for People with Cirrhosis

Despite the potential limitations on payouts, there are still benefits to having life insurance if you have cirrhosis. For one, having life insurance can provide peace of mind for you and your loved ones. Knowing that your beneficiaries will be taken care of financially can be a great comfort.

Additionally, if you are diagnosed with cirrhosis before purchasing a life insurance policy, you may still be able to get coverage. Some insurance companies offer guaranteed issue life insurance, which does not require a medical exam or health questions. However, these policies tend to have lower coverage amounts and higher premiums.

Conclusion

In summary, if you have cirrhosis and already have a life insurance policy, your beneficiaries will likely receive a payout if you die from the disease. However, the amount of the payout may be affected by the type of policy you have and any exclusions in the policy. If you are considering purchasing life insurance after being diagnosed with cirrhosis, it is still possible to get coverage, but you may face higher premiums or lower coverage amounts. Ultimately, the decision to purchase life insurance is a personal one that should be based on your individual needs and circumstances.

Frequently Asked Questions

People often wonder if life insurance will payout for cirrhosis. Here are some common questions and answers to help you understand how life insurance works in these situations.

What is Cirrhosis?

Cirrhosis is a liver disease that occurs when the liver becomes damaged and scarred. This damage can be caused by many things, including alcohol abuse, hepatitis B or C, and fatty liver disease. As the liver becomes more damaged, it loses its ability to function properly, and this can lead to serious health complications.

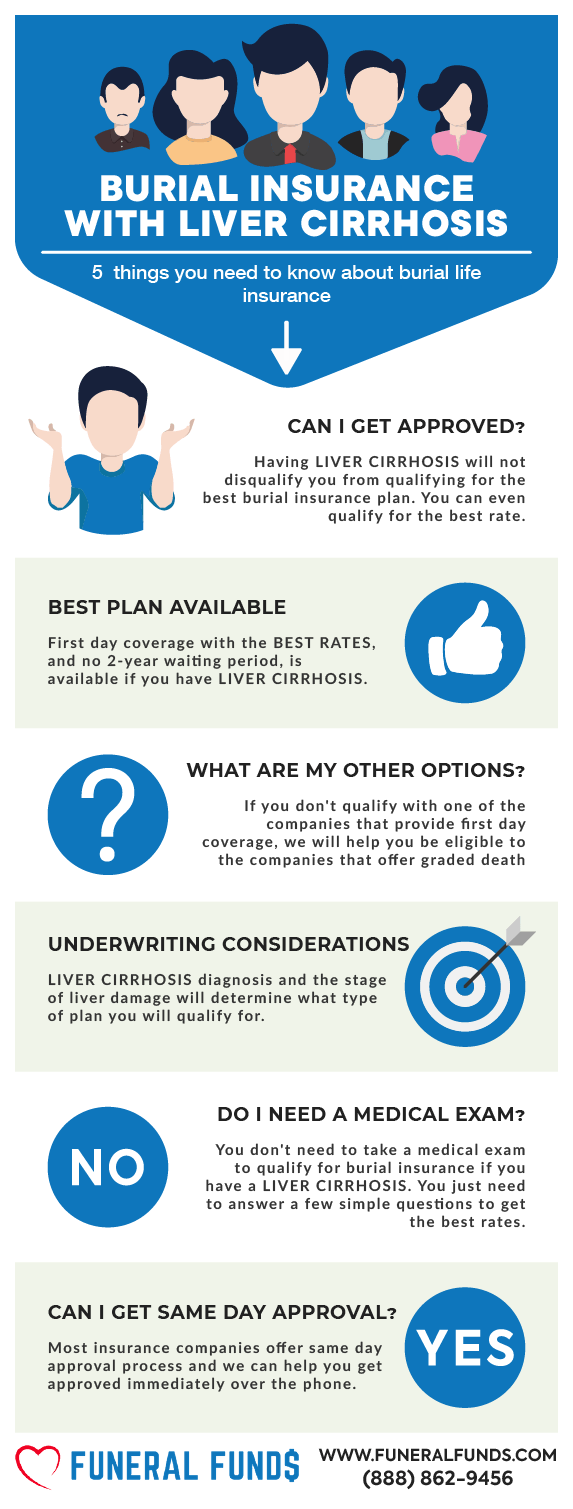

If you have cirrhosis, it may be more difficult to get approved for life insurance, and the premiums may be higher than someone without a liver disease. However, there are still options available to you, and it is important to explore them with a licensed insurance agent.

Will Life Insurance Payout for Cirrhosis?

Whether or not life insurance will payout for cirrhosis depends on the specific policy and the cause of the cirrhosis. If the cause of the cirrhosis is alcohol abuse, it may be more difficult to get approved for coverage and the premiums may be higher. If the cirrhosis is due to another cause, such as hepatitis B or C, there may be more options available.

It is important to note that most life insurance policies have a waiting period before they will payout for any cause of death. This waiting period can range from one to two years, depending on the policy. If you pass away within the waiting period and the cause of death is related to your cirrhosis, the policy may not payout.

Can I Get Life Insurance if I Have Cirrhosis?

Yes, you can still get life insurance if you have cirrhosis. However, it may be more difficult to get approved and the premiums may be higher than someone without a liver disease. You may need to provide more detailed information about your health history and may need to undergo a medical exam before getting approved for coverage.

It is important to work with a licensed insurance agent who has experience working with clients who have cirrhosis. They can help you find the right policy for your needs and budget.

What Type of Life Insurance is Best for Someone with Cirrhosis?

The type of life insurance that is best for someone with cirrhosis depends on their specific needs and budget. If you are looking for coverage that will last for your entire life, a whole life insurance policy may be a good option. If you are looking for coverage for a specific period of time, such as 10 or 20 years, a term life insurance policy may be a better fit.

It is important to work with a licensed insurance agent who can help you navigate the different types of life insurance policies and find the one that is best for you.

What Should I Consider When Buying Life Insurance with Cirrhosis?

When buying life insurance with cirrhosis, there are several things to consider. First, you should consider the cause of your cirrhosis and how it may impact your ability to get approved for coverage. You should also consider the waiting period on the policy and whether or not the policy will payout if you pass away within that waiting period.

It is also important to consider the amount of coverage you need and your budget for premiums. Working with a licensed insurance agent can help you navigate these decisions and find the right policy for your needs.

As a professional writer, I understand the importance of planning for the future and protecting oneself and loved ones from potential financial risks. This is where life insurance comes into play, providing a safety net for those unforeseen circumstances. However, when it comes to cirrhosis, a serious liver disease often caused by excessive alcohol consumption, the question arises: will life insurance payout for this condition?

The answer is not straightforward and depends on various factors. Firstly, it is important to check the policy’s terms and conditions to see if cirrhosis is covered. Some policies may exclude pre-existing conditions, including cirrhosis, while others may cover it but with certain limitations. Additionally, the severity of the condition may also affect the payout. As with any illness, it is crucial to be transparent with the insurance provider about any pre-existing medical conditions, as withholding information may result in the policy being invalidated. In conclusion, it is essential to thoroughly research and understand the policy’s terms and conditions to determine if cirrhosis is covered and the extent of the coverage provided. By doing so, individuals can ensure that they are adequately protected and their loved ones are financially secure in the event of an unfortunate circumstance such as cirrhosis.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts